december child tax credit amount

However theyre automatically issued as monthly advance payments between July and December -. Increased to 9000 from 6000 thanks to the American Rescue Plan 3000 for each child over age 6.

Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children.

. When you file your taxes for 2021 in 2022 you will receive the other half of the benefit. For many families the credit then plateaus at 2000 per child and starts to phase out for single parents earning more than 200000. For parents with children aged 5 and younger the Child Tax Credit for December will be 300 for each child.

The Child Tax Credit helps all families succeed. A single taxpayer with 2 qualifying children and modified adjusted gross income MAGI of 80000 can claim a Child Tax Credit of 1750. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17.

31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per. The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and 500 for college students aged up to 24. Here are more details on the December payments.

Number of Children x 2000 Maximum Credit. Total Child Tax Credit. Instead of calling it may be faster to check the.

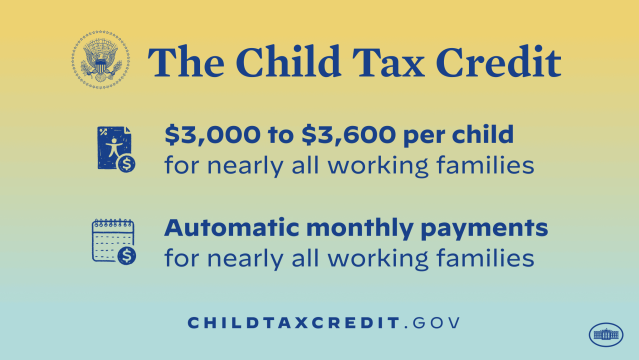

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. The credit amount was increased for 2021.

For each qualifying child age 5 or younger an eligible individual generally received 300 each month. This amount was then divided into monthly advance payments. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17.

For eligible families each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. It also provided monthly payments from July of 2021 to December of 2021. That is the first phaseout step can reduce only the 1600 increase for qualifying children ages 5 and under and the 1000 increase for qualifying children ages 6 through 17 at the end of 2021.

The child tax credits are worth 3600 per child under six in 2021 3000 per child aged between six and 17 and 500 for college students aged up to 24. The credit was made fully refundable. However theyre automatically issued as monthly advance payments between July and December - worth up to 300 per child.

Child tax credit for baby born in December 21 The total child tax credit of 10500 is correct. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. Congress fails to renew the advance Child Tax Credit.

The second phaseout can reduce the remaining Child Tax Credit below 2000 per child. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. An eligible individuals total advance Child Tax Credit payment amounts equaled half of the amount of the individuals estimated 2021 Child Tax Credit.

How to still get 1800 per kid before 2022. The first phaseout can reduce the Child Tax Credit to 2000 per child. Determine the modified adjusted gross income MAGI calculated on your Form 1040.

2 Children x 2000 4000. For parents with children 6-17 the payment for December will be 250. The Child Tax Credit provides money to support American families helping them make ends meet more easily.

You have a balance of 6900 for your older children plus 3600 for the newborn which makes a total of 10500. The maximum CTC payment currently stands at 300 dollars per month for each qualifying child under the age of six years and 250 dollars per month for each child between the ages of six and 17. Specifically the Child Tax Credit was revised in the following ways for 2021.

Child Tax Credit December. Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment. Families will see the direct deposit payments in.

The IRS bases your childs eligibility on their age on Dec. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit. Millions of families set to receive the final payment of the year.

However the deadline to apply for the child tax credit payment passed on November 15. President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022.

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Child Tax Credit Definition Taxedu Tax Foundation

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

What Families Need To Know About The Ctc In 2022 Clasp

The Child Tax Credit Toolkit The White House

2021 Child Tax Credit Advanced Payment Option Tas

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

Child Tax Credit Definition Taxedu Tax Foundation

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

The Child Tax Credit Toolkit The White House

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2021 8 Things You Need To Know District Capital

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit 2021 8 Things You Need To Know District Capital